Elevar | Powering Conversion Tracking For Over 6,500 D2C Brands

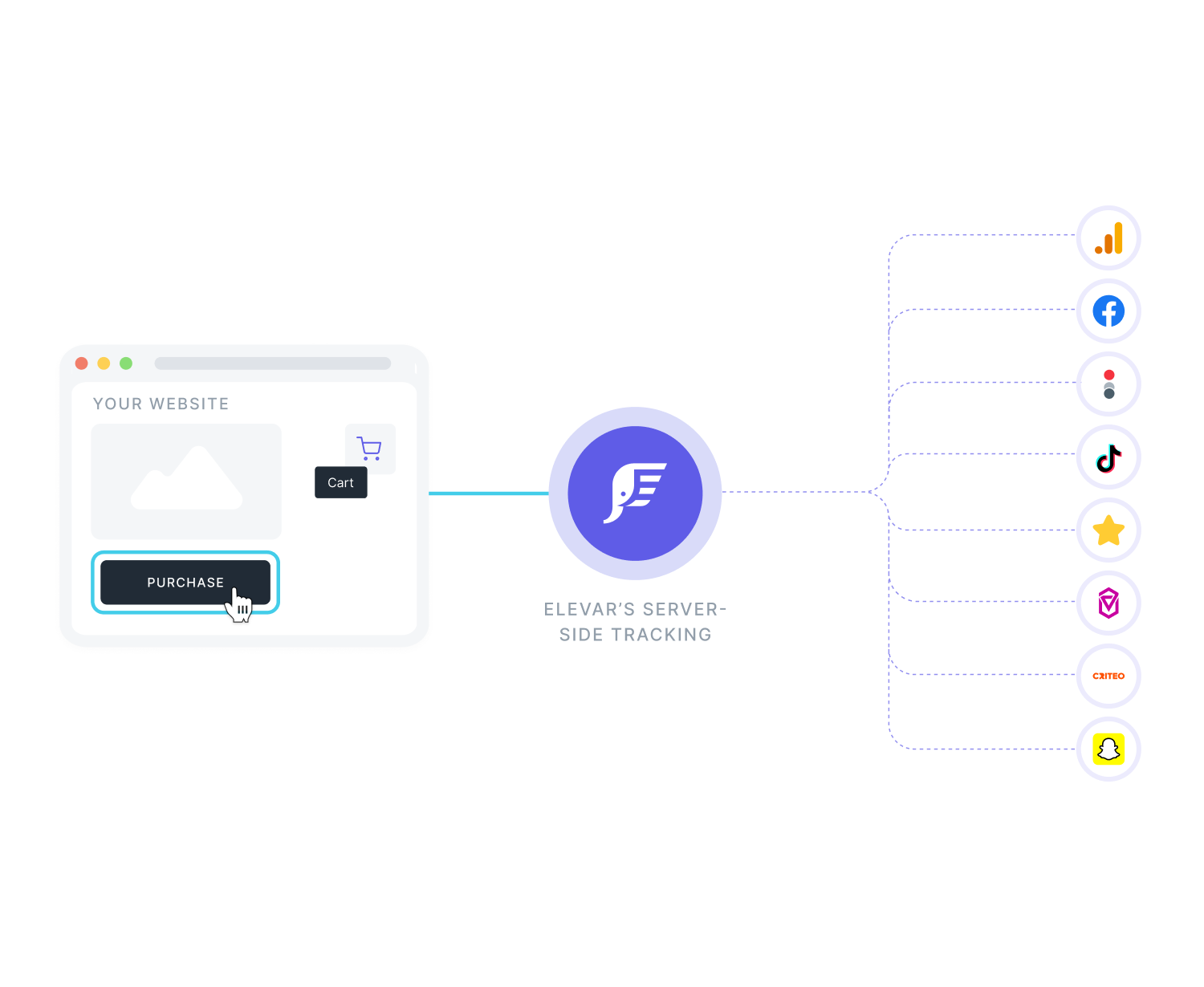

Never Miss Another Conversion

Ensure that 100% of your conversions are tracked and delivered to your marketing channels like Facebook, TikTok, Google Ads, GA4, and 40+ other channels with Elevar’s server-side tracking. Plus boost Klaviyo flow performance by 2-3x with Session Enrichment.

Plans from $0 a month + 15-day free trials on all plans

Marketers, analysts, and Shopify brand owners use Elevar for accurate conversion tracking

If any of this sounds familiar, you need Elevar

I need to improve tracking quality due to iOS changes

I need to improve tracking quality due to iOS changes I’m still using native Facebook or GA integrations with Shopify

I’m still using native Facebook or GA integrations with Shopify My server-side tracking is lacking

My server-side tracking is lacking

My existing tracking in GTM, my theme, and apps is a mess

My existing tracking in GTM, my theme, and apps is a mess I need a better Facebook CAPI setup for Shopify

I need a better Facebook CAPI setup for Shopify I need my tracking to integrate with my Consent provider

I need my tracking to integrate with my Consent provider I don't trust my Google Analytics data (or need GA4)

I don't trust my Google Analytics data (or need GA4) I want to upgrade to Shopify Checkout Extensibility

I want to upgrade to Shopify Checkout Extensibility My agency needs me to fix my tracking for Google Ads, Facebook, GA

My agency needs me to fix my tracking for Google Ads, Facebook, GA I want a first party User ID to recognize returning users without relying on cookies

I want a first party User ID to recognize returning users without relying on cookies Facebook is under-performing and think it could do better

Facebook is under-performing and think it could do better I’m missing conversions in Google Ads impacting performance

I’m missing conversions in Google Ads impacting performance

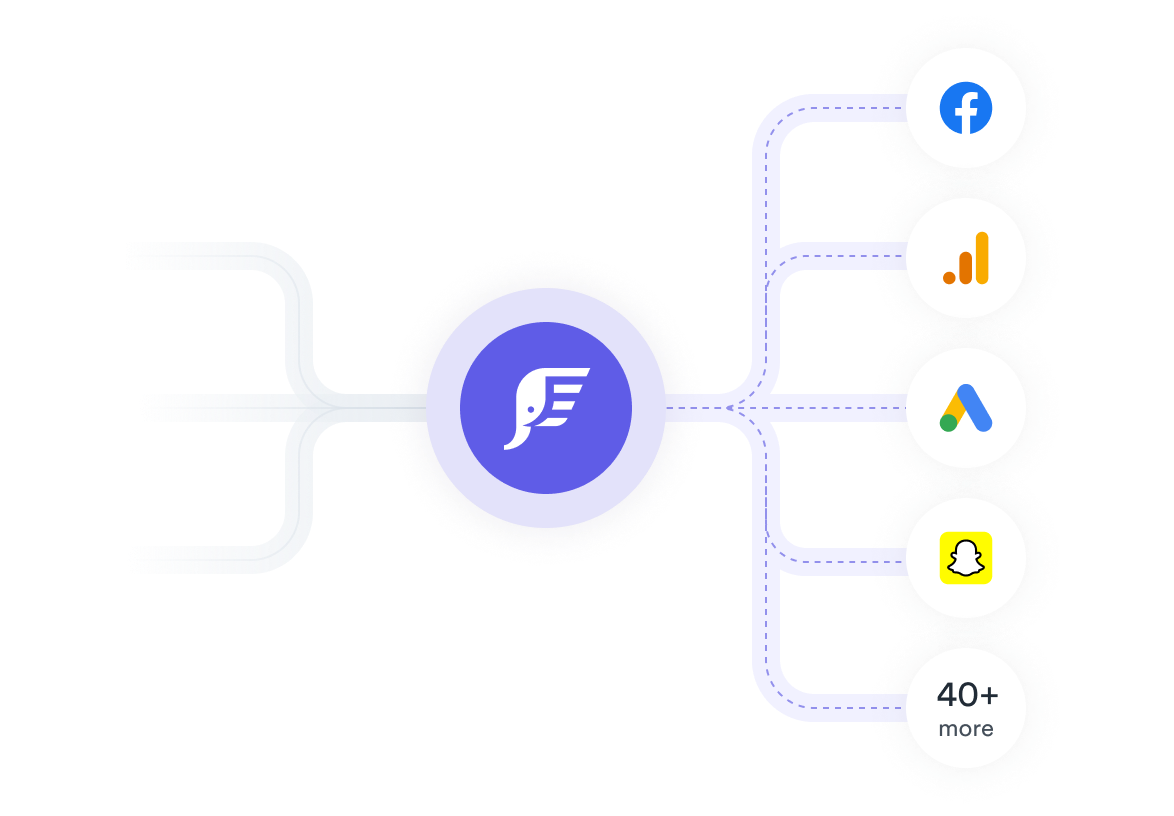

Do More with 50+ Integrations With Elevar

With real-time event monitoring and integrations with Facebook Conversion API, Google Ads, GA4, TikTok, and 40+ more digital marketing channels

“Amazing feedback, support, and optimizations. The team is extremely knowledgeable, and shares that info transparently. Education and execution are the hallmarks of the platform, but more importantly, of the team.

Amit Shah

Growth Marketing Manager, Buck Mason“The Elevar team is responsive and eager to help. We now feel that our site analytics are in a great place, and we get so much value in working with the Elevar Team.

Mark Duffy

Digital Marketing Manager, Owl Labs“I have a much better understanding of how minor changes can hugely impact different KPIs. The eCommerce strategy has also been greatly beneficial to how we think about long-term strategy and how we operate day-to-day.

Dylan Kim

Co-Founder, BrevitePrivacy Enabled Data Layer

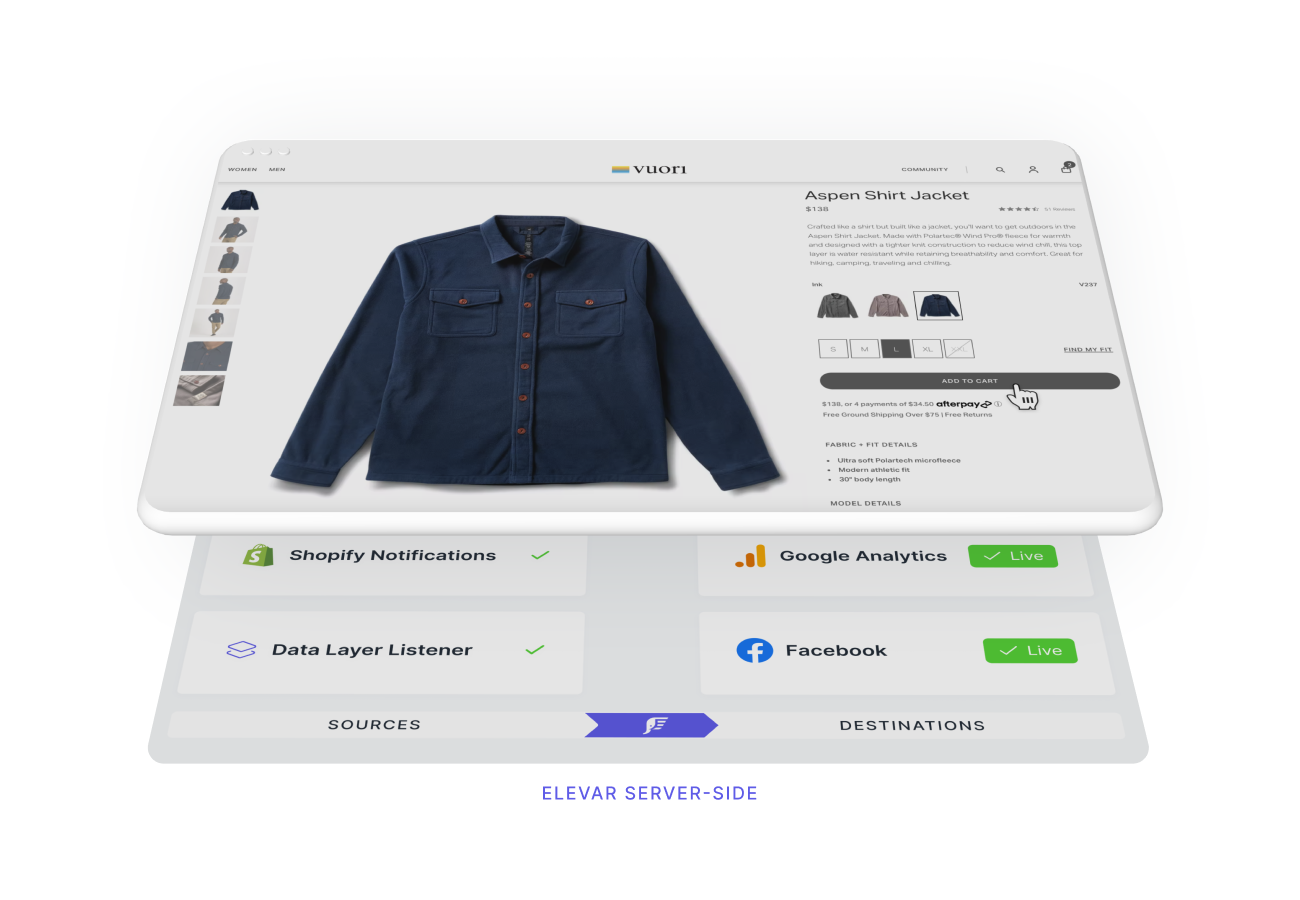

Our data layer and webhook integrations capture user behavior, marketing attribution data, customer data, and consent mode status.

This data is then used to power server-side tracking in Elevar or tags in your own Google Tag Manager account.

Client-Side & Server-Side Tracking

Most marketing channels are moving to server-side tracking to ensure 100% of first party data is collected to improve performance reporting and audience automations.

With Elevar, you can publish server-side tracking to Conversion APIs in a few clicks.

Or if you prefer client-side tracking, then utilize Elevar’s Pre-Built Tag library to use in GTM.

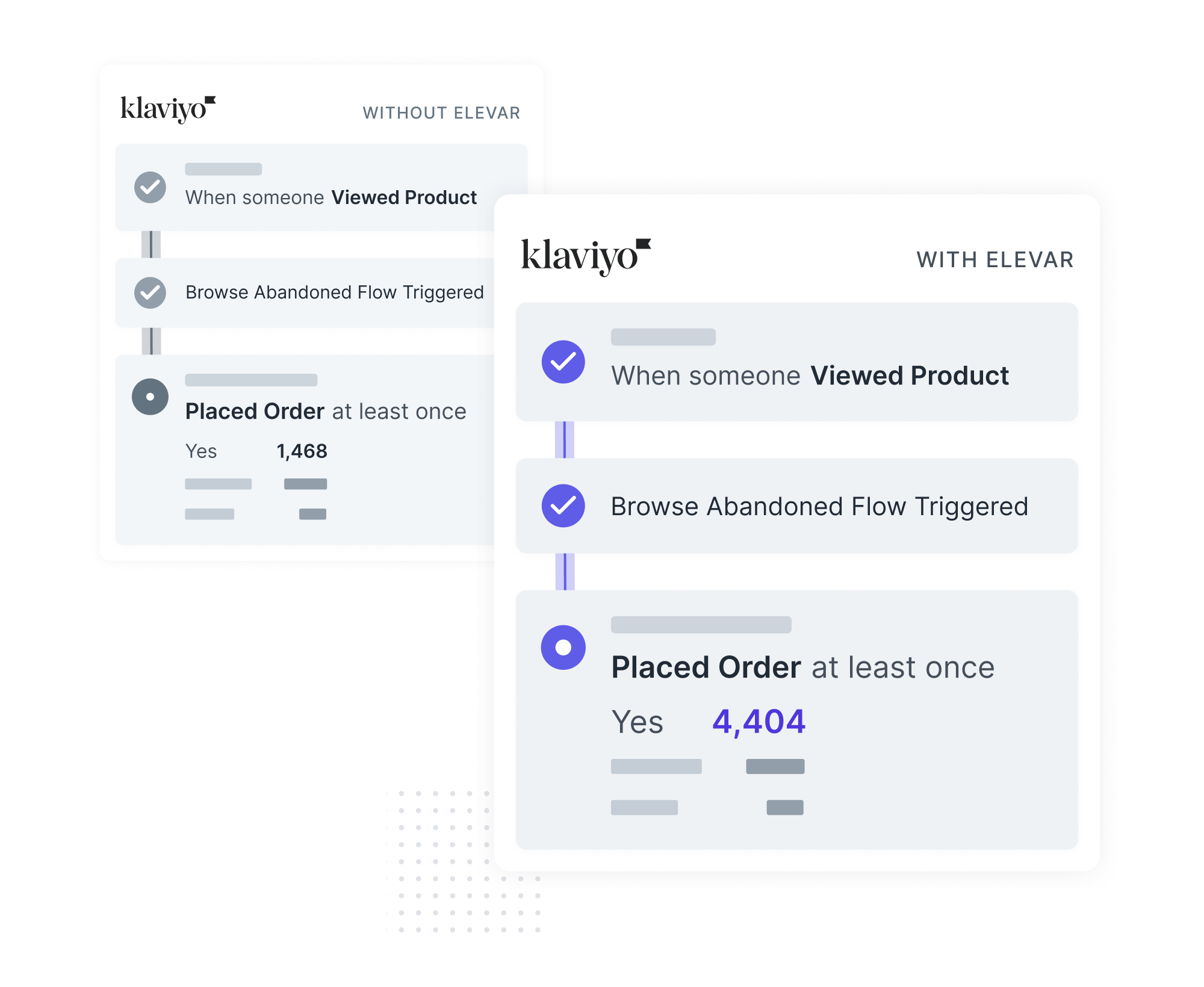

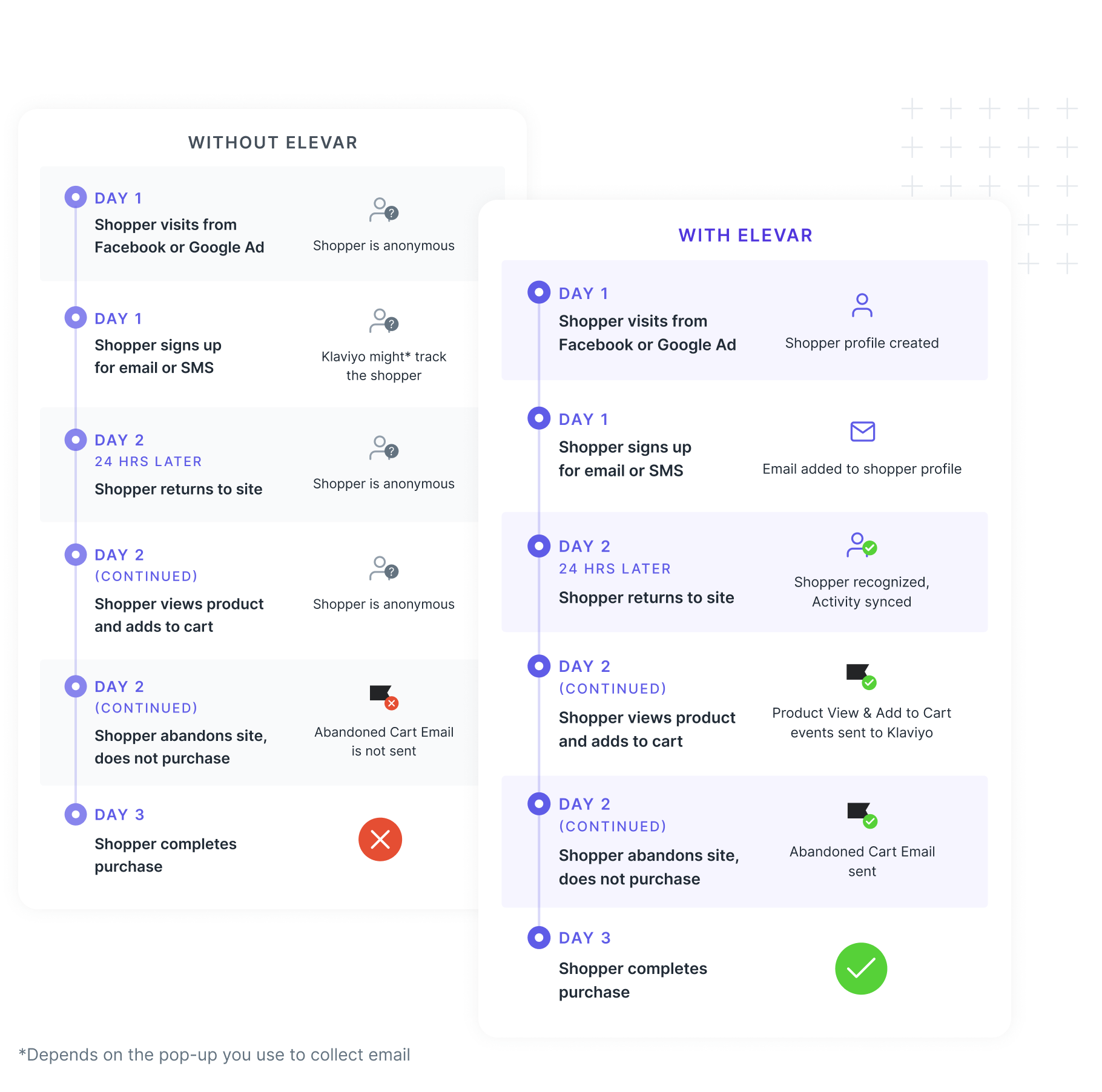

Recognize Returning Users with Session Enrichment

Boost your marketing performance: Elevar’s Session Enrichment instantly improves campaign ROI by recognizing returning users & enhancing data sent to Facebook CAPI, Klaviyo, Google Ads, and more!

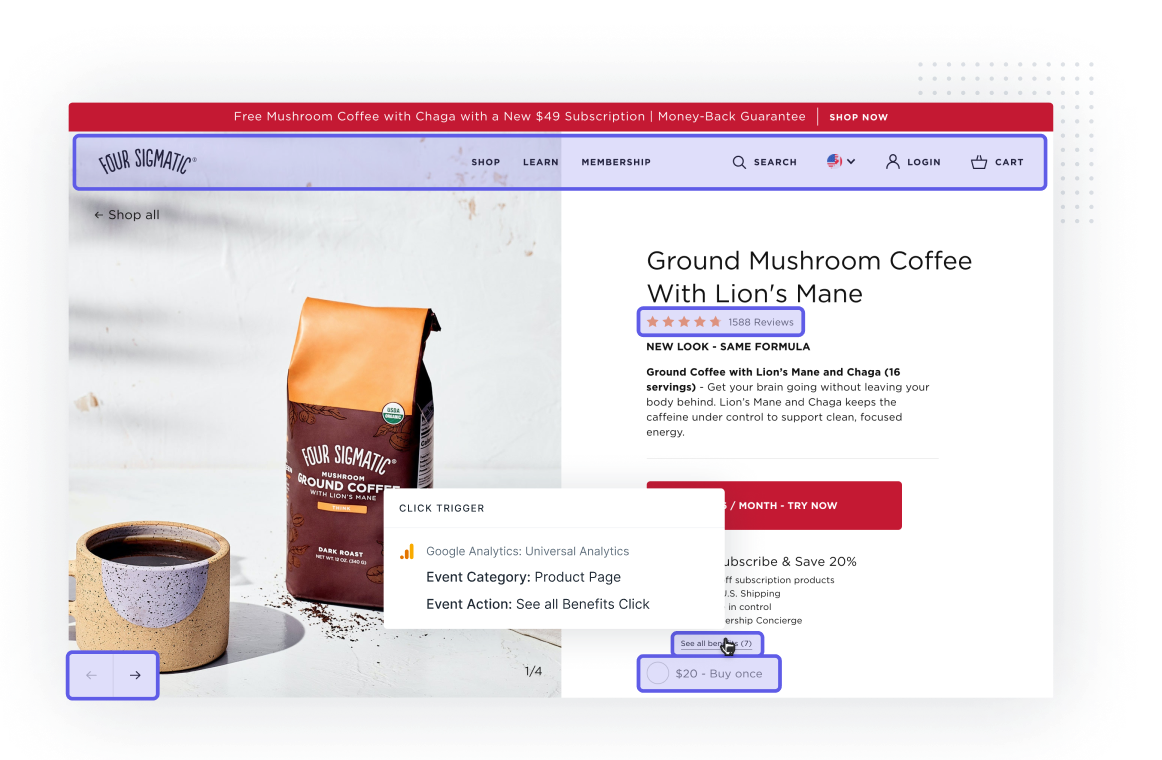

Launch GA4 and Enrich with Events

Is GA4 setup for success ahead of the July 2023 sunset date of Universal Analytics? Elevar helps automate the setup of accurate server-side tracking for GA4 and Universal Analytics. Plus our point-and-click Chrome Extension allows you to quickly add event tracking across your website that syncs with Google Tag Manager.

Boris Hodakel

Founder, Feel

“A gift that we have something like this that can be deployed with just a couple of clicks which makes my life easier…and I don’t get anxiety when I need to add something new.”

Gabriel S. Dias

Head of Digital & Growth, Vessi

“We’ve tripled in size which is quite a milestone. And our conversion rate has gone up significantly even with high volume of paid social traffic.”

Dylan Kim

Co-Founder, Brevitē

“15x’d our business in 3 years since working with Elevar. Laying down the foundational work early so we could see that growth was key to our success.”

Elevar simplifies the growing complexity of tracking and user identification all in one place

Your marketing team feels confident and sees their campaign performance improve. You get peace of mind, better performance, and more revenue.

Improve ad performance with better analytics

Improve ad performance with better analytics Reduce the cost to acquire new customers

Reduce the cost to acquire new customers Fully managed, and DIY server-side plans

Fully managed, and DIY server-side plans Real-Time Conversion Reporting

Real-Time Conversion Reporting Sitewide data layer for Google Tag Manager

Sitewide data layer for Google Tag Manager CCPA and GDPR consent integrations

CCPA and GDPR consent integrations Automated tracking alerts

Automated tracking alerts Facebook Conversion API

Facebook Conversion API Expert installation and setup options

Expert installation and setup options 99% conversion accuracy - guaranteed

99% conversion accuracy - guaranteed 4.9 out of 5 stars on Shopify's app store

4.9 out of 5 stars on Shopify's app store 24 hour, 6 days a week customer support

24 hour, 6 days a week customer support

Conversion Accuracy

Implement Elevar’s fully managed server-side tracking and we guarantee 99% of your purchase data will be successfully delivered to all of your server-side marketing destinations.

Money Back Guarantee

Our no questions asked 30 day money back guarantee is available on all plans. We’re invested into your success.

Ready to Get Started?

Try free for 15 days to start increasing performance through better tracking

You're In Good Hands

Proud to be official partners.