First Click or Last Click Attribution – That is the Question

Learn how brands are leveraging attribution to help improve key metrics like LTV, cost per order, cost per acquisition, and ROAS.

Common existential woes that plague all marketers:

- Are we responsibly scaling our budgets, or are we lighting a pile of money on fire?

- Are we spending the right amount in the right channels to maximize profitability?

While there is never one solution that will cure marketers of this dread, building a single source of truth based on a solid attribution model is a great way to relieve most of the stress that these swirling questions cause.

When the team has one “language” they can use to analyze their marketing performance, the decision making framework goes from very complicated to manageable, and the joys of marketing will return.

What is Attribution?

Marketing attribution consists of modeling and analysis that help eCommerce brands understand which of their marketing channels gets credit for a sale.

At the highest level, analyzing your attribution is an exercise in understanding the customer journeys that lead to purchases and which marketing channels are most responsible for driving purchases.

As you dive deeper, you can start to answer many questions about your marketing, including:

- Are we spending the right amount in the right channels?

- What channels are driving the most sales for our brand?

- Is our marketing profitable?

- How do customers get to our site to make purchases?

That last question becomes even more important as your brand grows and your marketing becomes multi-channel. The more complicated your marketing, the more complicated the customer journey:

Based on this visual, which channel would you credit for the purchase?

This customer journey shows a customer with 6 touch points (impressions) before they purchase. Two common ways to credit this purchase (i.e., two different attribution models) would be via first-click attribution or (more commonly) last click attribution.

In this case, first-click attribution would give sales credit to Google, and last-click attribution would give sales credit to the paid social channel. However, the customer made the purchase with a podcast promo code, which they heard in the middle of their journey.

Here’s a deeper dive into how to simplify this complicated process:

Why you shouldn’t trust vendor-reported data

Relying too heavily on vendor-reported data means you’re basing the foundation of your marketing decisions on unreliable data. Historically, vendors have been incentivized to overreport performance numbers to make their advertising platform look as attractive as possible.

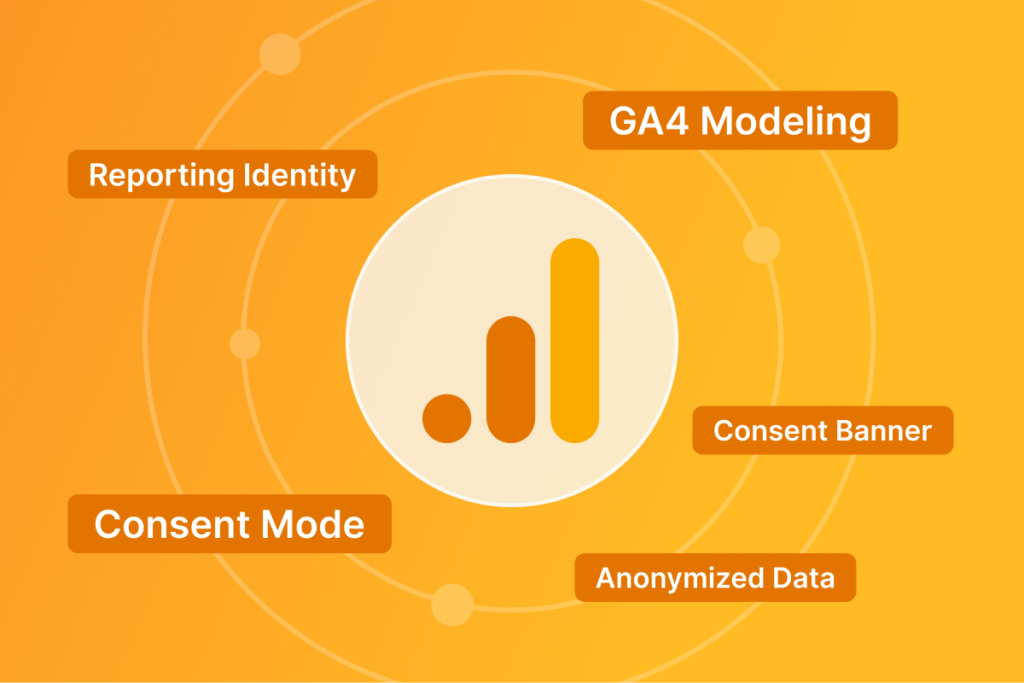

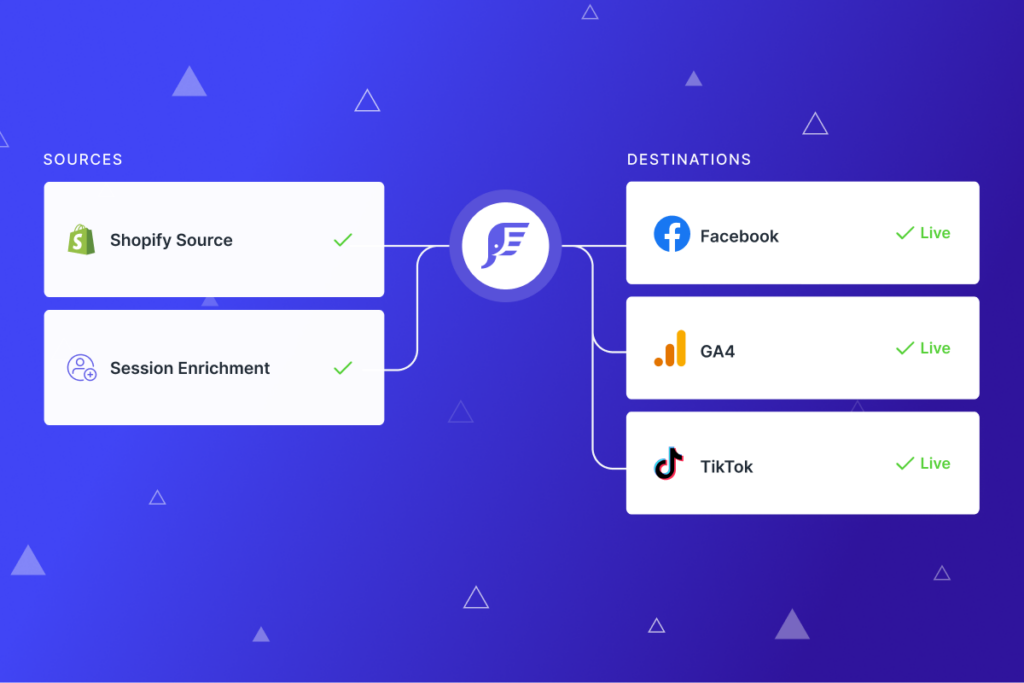

Given the recent iOS updates, however, the inverse is now happening: vendors are now underreporting performance because they can no longer capture enough data to provide a true picture of how your marketing is performing (but using solutions like Elevar helps maximize the total amount of data that channels receive via server-side tracking).

In addition, as your company grows and your marketing mix becomes more complicated, customers will interact with multiple channels before they make a purchase.

Understanding the customer journey and how customers interact across marketing channels before making a purchase is the key to scaling your budgets.

Instead of relying only on vendor reporting, you should also have your own third-party analytics/attribution platform to verify the information across channels.

Why is Accurate Attribution Vital?

Using a marketing attribution model provides a standard way to evaluate the performance of your different marketing channels, which you can use to inform future strategies and budget investments. It also shows you why it’s important to take vendor-reported data (e.g., Facebook attribution) with a grain of salt.

Data from multiple sources (and an attribution model that helps you compare the efficacy of different channels) allows your team to be confident in identifying what an order really costs, making it easier to justify every dollar spent.

Instead of basing marketing analysis on channels that appear to be performing well versus those that aren’t, you can expand the analysis to include channels that are feeding the performance of other channels. This can result in a more productive assignment of funding for each channel.

Additionally, your stage of growth and current financial situation will have a noticeable impact on your attribution model. At a high level, companies that are more focused on immediate conversions typically lean towards a more heavily weighted last-click attribution model, while companies that are more focused on “building the brand” and top of funnel exercises tend to focus on first-click attribution.

If everyone on your team (including leadership and finance) has a common language and set of reports, they will all understand how marketing is performing and how to best allocate budget – thus quelling anxiety over marketing spend and results.

Pro Tip: It’s rare that one attribution model will be right for your business. It’s likely that a combination of attribution models is necessary. There are many different types of attribution models, and your business will have an inherently custom element to the strategy or customer buying journey, which will require adjustments to your attribution model.

The secret behind attribution is that there isn’t really a single “right” answer about how to approach it and which model to use. Ultimately, it comes down to selecting one for your brand, testing it over time, and sticking with it.

How to Use Attribution Data

Now that we’ve covered how to determine your attribution method and the process you’ll use to analyze your data, let’s discuss the key metrics that will serve as the foundation of your marketing strategy:

-

- Cost Per Order (CPO): The marketing cost to drive an order (New and Returning customers)

- Cost Per Acquisition (CPA): The marketing cost to drive a purchase from a new customer

- Customer Acquisition Cost (CAC): The marketing and sales cost to drive a purchase from a new customer (this is inclusive of salary, tooling and vendor costs)

- Talk to your finance/accounting team about how your company calculates this metric.

- Return on Ad Spend (ROAS): The return in sales driven from your marketing spend during a given period

The attribution model you select will feed the data behind these metrics. Additionally, how you decide to allocate revenue to specific marketing channels will greatly change the results in these metrics.

Thinking through which channels drive new vs. returning purchasers and how much credit you want to allocate to each will have a high impact on metrics like CPA and CAC.

Pro-Tip: One of the biggest insights most companies discover from their new attribution model is how vendors misattribute new vs. returning customers. (Spoiler alert: vendors usually claim returning customer sales in their reported CPA, which isn’t accurate since your brand may not be acquiring a new customer from that channel!)

Once you understand your baseline performance of these metrics, you can set goals for your marketing performance. By tying in metrics like Gross Margin and Contribution Margin, you can identify the appropriate CPO and CPA/CAC targets (largely depending on how your finance team measures these) necessary to scale your brand.

At the brand level, you should monitor Blended CPO and CPA/CAC both company wide and at the channel level.

This is where we translate the science of attribution into the art of managing marketing spend. While you need to maintain your company-wide Blended CPO and CPA/CAC targets, you should adjust them by channel and strategy.

Final Thoughts

Regarding new vs. returning customers: determining which marketing channels are going to drive revenue from acquisition (new customers) and retention (returning customers) dictates your target levels for each channel.

When you focus on a channel best used for acquisition (e.g.,Facebook/Tik Tok), you should expect to see higher CPAs, while a retention channel (e.g., email/SMS) should bring your overall CPO down by driving revenue from less expensive channels.

Again, there is no universally right answer here. The most important thing you can do is to have a well-defined process that is well informed by current performance and margin information to ensure that you are driving high return growth.

—

This is a guest post from our friends at Daasity.

Leave a Reply