How To Measure New Customer Acquisitions Using a Goal-First Approach and OKR Framework

Brad Redding speaks with Dan Hansfield, founder of DataSmith on data tracking pre-work – defining goals, creating a measurement strategy, executing efficiently and making data-based decisions faster.

Brad Redding speaks with Dan Hansfield, founder of DataSmith on data tracking pre-work – defining goals, creating a measurement strategy, executing efficiently and making data-based decisions faster.

Q: Give us a quick overview of DataSmith

Hansfield: Sure. We’re focused on helping e-commerce companies close the gap between data, action and aligning your business objectives. I started about two years ago after discovering a great opportunity in the e-commerce and CPG space. I’ve done similar things in hospitality and fitness and we find that there is a lot of rich customer data and opportunity to learn about your customers. As technology catches up, we have some great data sources we can use. It’s just a matter of closing that last piece – we have the insights, now what do we do with it?

Q: If a brand needs to start extracting more insights from Google Analytics, Shopify or another platform, what’s should be the first step? What have your customers been most successful with?

Hansfield: Identifying your business goals – that brings the most success. What am I trying to achieve in my business? What are the specific goals I’m trying to reach? What could increase new customer acquisitions? It could be retaining more customers or trying to bring more customers back. Keeping that goal in mind is the key to building out a strategy around data points to track that specific goal.

Q: So instead of just deploying several tracking tools, we should identify what questions you are trying to answer and what goals are tied to those?

Hansfield: Absolutely. Once we get to a place where all the data is coming in, it can quickly become overwhelming. Many companies, especially those who started out within the last few years, are wearing a hundred different hats. You have some ability to glance at data in Google Analytics or Shopify to glean some insights, but it’s very overwhelming if you’re not in this every day. So it helps to start with the specific business goals you’re trying to achieve. Once you have that defined, you can start thinking about what specific data points you care about and which ones you need to be paying attention to.

Q: What are the benefits of taking a pause?

Hansfield: One of the biggest benefits is that when you start from this place, you start to understand what data you need to move forward. You will often find that you already have or are close to getting the data you need to make more data-driven decisions. If you start with data very quickly, you will discover that your data is not perfect – you might have trouble trusting data from certain areas; you may have incomplete data in other areas. That’s when it is easy to get tangled up – trying to collect all the data in one place and making sure it’s all perfectly accurate. You end up either spending a lot of money trying to do this or with everything else going on, it goes to the back burner. When you think about your goal and about specific ways about connecting that goal to data, you think ‘well maybe there is a data point that I already collected or am close to collecting that I can use to measure success.’ It might not be perfect, but if it moves up, I know I’ve done well. If it moves down, I know that I’m doing poorly and that’s what we can go back to.

I can validate that almost 100% of the customers that we work with at Elevar either have data they don’t trust or they have an incomplete data set. I agree that sometimes being hyper-focused on perfection and data can lead you to analysis paralysis.

Q: Should you establish a consistent baseline and monitor instead of striving for perfection?

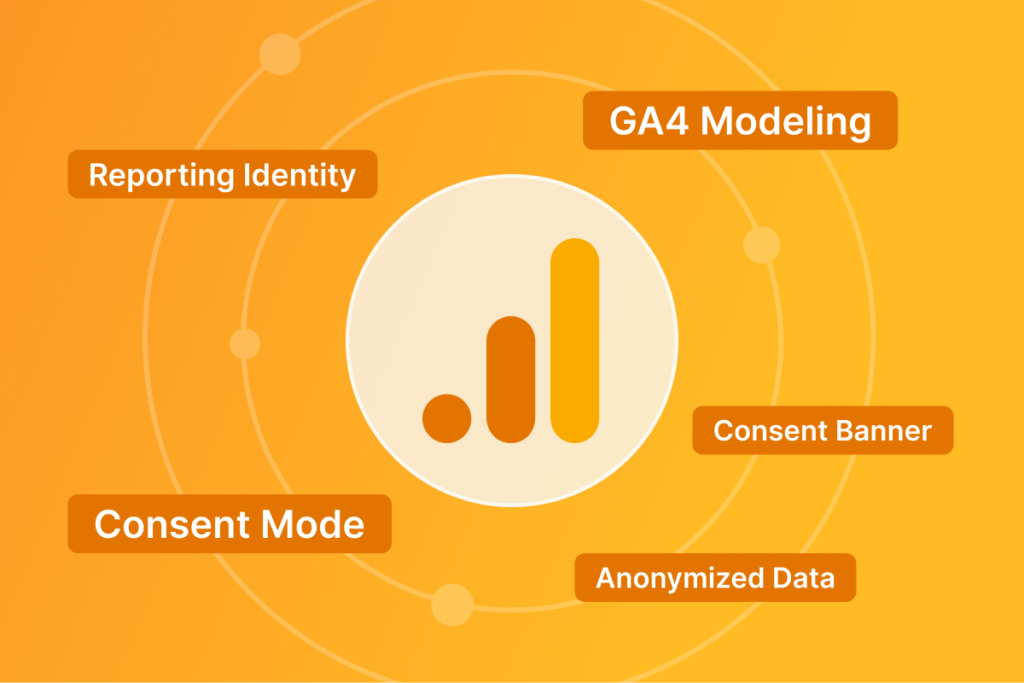

Hansfield: Consistency is key – consistent data is so much more important than 100% accurate data. I’m all for getting better data and I think that’s really important – that is often the next step where we try to improve the date. And that’s where Elevar comes in and other tools that help us improve attribution. It only gives us better ability to take action. To your point, they get us closer to accuracy but we’ll never get to 100%. Sometimes in e-commerce, we forget some of the data doesn’t even exist because many people are hearing about our brands through word of mouth. It’s difficult to get that data.

If you have a way of measuring data that is consistent both over time and across the different ways that customers are finding you, then you can look at changes when you start segmenting that data in different marketing channels, locations or customer demographics. Then you will be able to start to answering some of those really tough questions – I’m investing a lot of money for marketing here, is it actually working? You can do that from day one when you think about your goal, data and what you can use to measure that.

Q: Can you talk about what this process looks like through a customer example? What were their goals, how did you implement a measurement strategy, what did you extract from that and how did they apply that to their business?

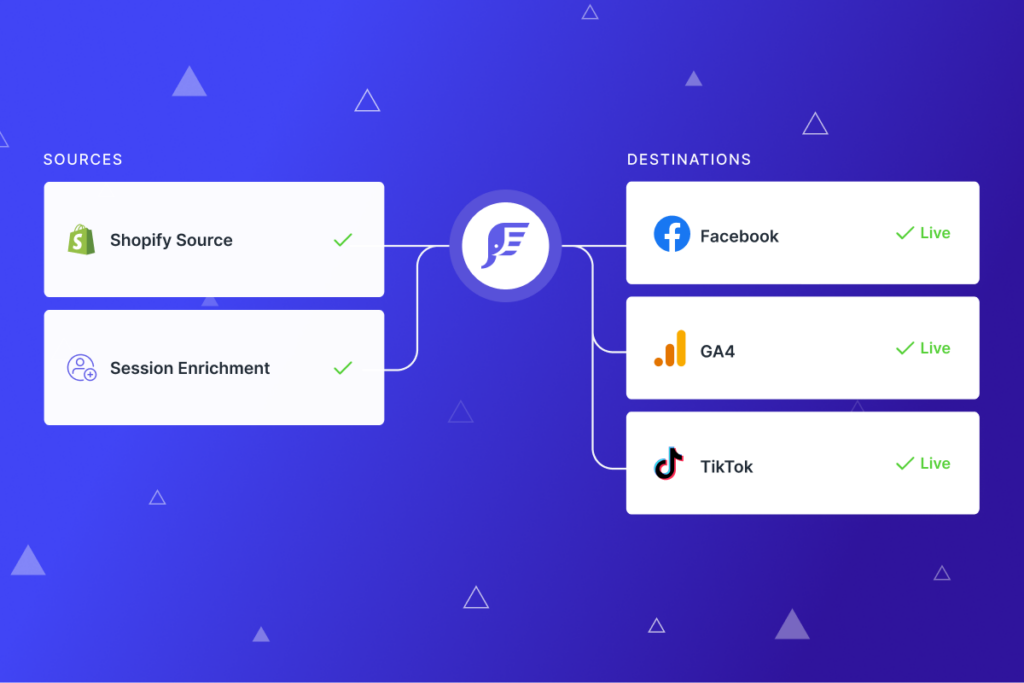

Hansfield: Absolutely. One common example is looking to acquire new customers, get new business and to grow customer-base overall. A client I recently worked with deployed a two-pronged strategy for this. They were looking to gain customers through Instagram and TikTok. They had a basic GA setup. They were working with Elevar so it was better data, which gave us a lot more flexibility. They started with ‘I can’t measure this data. I can’t see everything coming through TikTok or Instagram but I know that it must be working because I’m getting new customers. How can I know for sure?’.

That’s when we took that step back and I asked, ‘what’s your goal here?’ The goal is to get new customers. So we put a number around that. They wanted to be 20% over the previous year. What can we actually see to measure that? The key metric turned out to be new customer orders on Shopify. Shopify customers are easy to segment between new and returning customers. That’s the metric that we really cared about and wanted to see lift there. How will we measure progress? One is new customer orders and the others are looking through Google Analytics. We expect to see more people coming to the site. If more people are making purchases, we’ll see an increase in visitors, particularly new ones. When we start to think about deploying capital to TikTok and Instagram, they started pumping the money in, the key metrics we tracked at this point, weren’t conversions on Instagram or TikTok, which can be partial. It wasn’t what we saw in Google Analytics because we knew that wasn’t complete.

Q: What were the results and what they learn?

Hansfield: When they put $20K into these two channels, new customers increased by 10% lift in the first month on Shopify. Now in Google Analytics, we saw a handful of visits from TikTok, but no conversions. That is very normal. A lot of people see that and think it is not working. Same with Instagram, it does a better job. Facebook ad manager says this is off the charts. Does this mean that we put all of our money towards Instagram? When we took a step back and looked at it, we noticed that the people in Instagram were more retargeted. We dug into this data more and saw there were a lot of returning customers. That wasn’t necessarily building our base. TikTok is where we actually saw that if we invested more here, our new customer numbers go up. We couldn’t connect it through the data. If we were looking for perfect data, I don’t know a great solution right now that would’ve gotten us that perfect data. We might have been close though that is a pretty big process. We were able to see that by thinking about the goal first (new customers), the way to measure that goal, new customers in Shopify, to say yes, this is working. We put more money here, we see it grow in new customers. Maybe it’s through organic search, people coming direct to the website, but we can attribute that growth.

Q: Were you looking at the percentage or raw value?

Hansfield: The raw value. You want to think about the KPIs that measure success. Almost always, we’re going to look at total values. Percentages can be misleading because there are often things that can move it in either direction and success can be in either direction. A great example of that is retention rate. Our returning customers percentage went down. That seems bad. But in reality, returning customer sales were staying at level and it was the new customer sales going up. That drives down the percentage metric. When you look at the total, you see that you’re coming ahead.

Q: Were you running experiments? For example, one week you’re running Instagram and seeing how that drives that new customer number in Shopify? And next week, you’re trying TikTok and seeing how that affects that same number? Or running in parallel?

Hansfield: In this case, we did them sequentially. We did it one month and then other month. Doing it in parallel is trickier because they can have two different factors. I think if we had done it in parallel, we would have known that both were working. We wouldn’t have necessarily known the difference between them. Because we did it in parallel, we were able to see with Instagram, attribution come in, there was a much smaller lift in actual change in sales. That’s how we knew that most of that attribution must have been through returning customers or retargeting because they were likely to like the brand. They already do like the brand. It is an easy sell. TikTok had the real growth.

Q: One of our long-time customers dabbled in different attribution and e-commerce analytics tools over the years. They’re always trying to answer that question – ‘which channel is driving top of funnel?’ They took insights from another tool that basically said Facebook wasn’t doing anything for them even though Facebook Business Manager said they were doing ok. So, they cut that channel off. A month later, they saw their business was down significantly and realized that it was not the right decision to make. Have you seen this approach in your experience? Or would you have led them on a different path?

Hansfield: There are a few things to unpack there. Definitely kudos to them for experimenting. Brands that find out what works, find new ways to get ahead, are the ones that experiment. Even experiments don’t always work. You will need to try a lot of things before you find what does work. Even just testing it out and trying something new is almost always the good call. By not going with a goal-first approach, the pitfall we can run into is letting an experiment run for much longer before we shut it down. The way the numbers work out, most of the fall they would’ve seen from Facebook certainly happened pretty early on. You might not see it in the numbers completely at first, but within the first week or two, you can almost always see the impact of cutting off a source like Facebook.

If you start by saying you want to see change in new customer sales, then instead of waiting to see your overall final monthly numbers or what is attribution from other channels, hop in there a week later and ask if that’s what you’re seeing (increase in new customers). If you see that number fall, you’re nervous. Maybe there are other factors. If it’s been two weeks and you’re still falling, that’s when you’ll flip that switch really fast and then it’s another experiment. See if it goes back up, if it stays low, it brings you down a path where you’re wondering what’s really going on here. But definitely by thinking about the goal, it shortens the time from the start of the experiment to when you can really know that you’re seeing a business impact.

Q: Do you have another example that’s a real-life use case as interesting as the one we just talked through?

Hansfield: Yes. I spend the most time in three areas: customer acquisition, website conversions and retention. And retention is critical. Understanding the retention funnel can be huge to really understanding how you’re performing. A big part of retention, when we think about the goals, will often go to thinking about LTV and retention rates and how do we increase these numbers? LTV becomes an area where we want to see brands reach a specific LTV, or they want to grow or reach it. Sometimes we’ll start thinking first about retention and AOV and they have all these metrics out there, they want to see increase. But those all build up to that LTB number.

We talk about what are the pieces of LTV that you want to increase? And what can we track? But the ultimate goal is that you want to increase the value of each individual customer. An example where we might use that, is if a brand is looking for ways to increase LTV and get more high value customers, if that’s your goal, the next step is to attract more high loyalty customers. The people who have the highest LTV, if you can increase that pool, you’re going to increase the value of your brand overall with the customers you have. Then we can start to play it backwards, to start to understand that specific segment of customers. And now to target that group of high LTV customers, bring more of them into your store at the beginning of the funnel, identify those sooner who might be primed to become high value customers, and really start to move the funnel.

Where this comes into play and why this is so important is the goals-first approach helps us take the thought of let’s understand that customer, think about the behaviors that can bring them back in. If we think about metrics first, we might focus on pieces that don’t matter as much. How can we increase retention? A great way to increase retention and you might be able to double your retention, if you offer an awesome discount after the first order. The problem is that’s probably not going to actually increase LTV. That’ll bring in more value seekers, not that high value core group you want to attract. So by starting with the goal, you can have a better mindset and idea of who you actually want to attract and the best way to do so.

Q: Can you unpack that a little bit more? How would you actually take that and put that into the next step? Are you starting to pull data points out from them like what was their first product they purchased or what were some data points that led them to reach that VIP status?

Hansfield: One of the biggest ones is identifying them early, taking and doing things that can help improve their experience and give them a special notice early on. You can’t do that. You can’t give white glove service to every single customer, but if you can start to identify those potential high value customers, it’s amazing what a few extra touches can do to really turn them into who they can be. Across many brands and industries, you’ll find that people who come back very quickly for a second order are much more likely to be future loyal customers. One of the things I’ve done with brands is set up a specially now campaign for people who make a second purchase within a certain time period – that connects with them at a more personal level than for their normal customer base. Brands that have been very successful go so far as to write personalized emails, phone calls and text messages to the cohorts of customers who look like their loyal customer. Even after one or two purchases, they say this person has the behavior that my most loyal customers have. Let me give them that special attention. It might be a hundred customers a month, but over time that does a huge amount to increase that goal of growing LTV.

Q: My friend Ian, co-founder of Laundry Sauce, his team sent handwritten notes after the first order which was unique. That’s personal connection! I’m assuming they’re going down that same road of trying to hone in on those VIPs and turning them into high value LTV customers.

Hansfield: Things like that really sets brands apart and gives them the edge. If we’re too focused on the data, it might be, ‘how can we optimize this email campaign?’ When you step back, you think about your goal and you start easy. The first 10 people to reorder each month at the shortest reorder window, send them that personalized note, chances are, you’ll see such success from that, that you’ll increase the time you take to do that. A brand might get to the point where they send it to everybody, but you can really start small, focus on a certain segment, see if it works and go from there. That’s a great example!

Q: What are other challenges or issues that brands come across if they don’t take the goal-first approach?

Hansfield: One piece that we haven’t touched on is where should this data be coming from? And at what point should you start investing more in tools to collect better data? And is that something you should do? It’s really important to know that will always will improve your ability to make better, faster decisions. If you’re thinking about where to start, I recommend Google Analytics, but there’s definitely a huge opportunity for a lot of other great companies who are going to help you bring it to the next level, to come in and play a major part in helping you collect more data, have more insights and see the data from different angles. At that point, it’s about committing and using the tools you choose and looking through a single lens at all of your channels. It’ll give you the consistency. You need to measure channels against each other and understand changes over time.

Q: Do you see different owners of the LTV metric or the new customer acquisition? And the goal-first approach? Do you see that owned by multiple people within an organization once they get to a certain scale, like a $100M+ brand?

Hansfield: Most of the brands I work with have a smaller back-office team. Everyone is wearing a few hats. A lot of brands do get to the point where they’re bringing people in house who can start to work internally to connect these pieces. That’s a really exciting place of any brand’s journey and I love to see them get there. The people I work with, whether they’re $1M or $100M, their back office team is really in need of someone who can ask those questions – ‘what does this data mean? What does this data tell us and what data should I be looking at to understand what my business is doing?’

Q: It sounds like if a company has the capacity, they could focus on LTV and potentially a handwritten gift card or gift note to send out, to try to increase that while doing the Instagram versus TikTok type of testing in parallel.

Hansfield: Absolutely. Part of the goal-first approach is that it lets you think about if different goals are going to be moving metrics in different ways. These two examples are great because you’re looking at very different numbers for the two of them. In one case, you’re looking at changes to new customers over time as the raw number. In the other case, you’re really looking at how long customers are sticking around, how you’re growing that very loyal base. You can absolutely see both of those grow. You can measure those two metrics and goals independently at the same time. Those might be owned by the same or different team, it really depends on the company structure. In the best case, the goals-first approach for being more data driven, is always most successful when it runs through the whole company. It becomes part of the company’s DNA, that’s when companies start using their data in ways that can really push the business forward.

Q: What you described seems to be similar to the OKR objectives and key results. Is this part of the OKR framework?

Hansfield: Yes. If you’re familiar with OKRs, then this approach should feel familiar. It starts with the overall objective and the different metrics that are coming up to it. Many times, that’s what it can look like. Once we get into it, I would recommend starting simple – look at one metric for your goal. But as you keep going, you will have your top three goals and three metrics to measure each one, each of your key results. That’s what we see a lot with this too. We’ll get to a place where we have three different objectives we’re working towards. Then three of those key metrics we look at and those metrics. Are the numbers perfect? No. Is it going to be 100% accurate? Absolutely not. But does a movement up means one thing and movement down means another? Because we’re consistently measuring it, we know that if it’s up, it’s good. If it’s down it’s bad.

Another piece to keep in mind is that OKR framework is structured in a way that it brings both top down and bottom up goal setting in your organization that lets you see how each individual department’s goals lead to the overall organization. In this case, it goes back to what we said before about becoming a data driven organization, it plays really well with OKRs. It makes everyone at the company start thinking about how do the metrics play into the goals that both I’m trying to achieve as well as the company

Q: My good friends at Brevite started implementing OKRs last year. It seems to be growing in adoption with eCommerce brands to help give teams more autonomy and freedom to help steer the ship.

Hansfield: That’s a great to see. If you’re thinking about taking on OKRs, you’ll hear about how it’s a process where you need to go through it a few times to really feel like you get those key results. Part of that is starting to understand what key metrics, when they move in one direction, does movement actually associate with something good? Revenue growth is almost always good. However, retention rate, the percent of new customers versus repeat, it might be good or bad. If you really want to focus on new customer growth, the percent of returning versus new customers is going to go down and that’ll be okay with an OKR the way it’s set up. It makes you think that’s not going to be a good indicator of success. What can I actually track from point A to point B?

Q: Thank you for your insights. How can people get in touch with you?

Hansfield: Thank you for having me. You can learn more about us at askdatasmith.com where you can also schedule a meeting with us. Or feel free to email me at [email protected].

Excerpts from The Conversion Tracking Playbook podcast hosted by Brad Redding, Founder & CEO of Elevar.

Leave a Reply